How is the NHS in Wales funded?

In short, the NHS in Wales, like the NHS across the rest of the UK, is publicly funded. This means it is funded by taxpayers' money, primarily through general taxation and National Insurance contributions. As health is devolved to Wales, the Welsh Government sets the allocation of funding for the NHS in their Budget.

Where does the Welsh Government get its money?

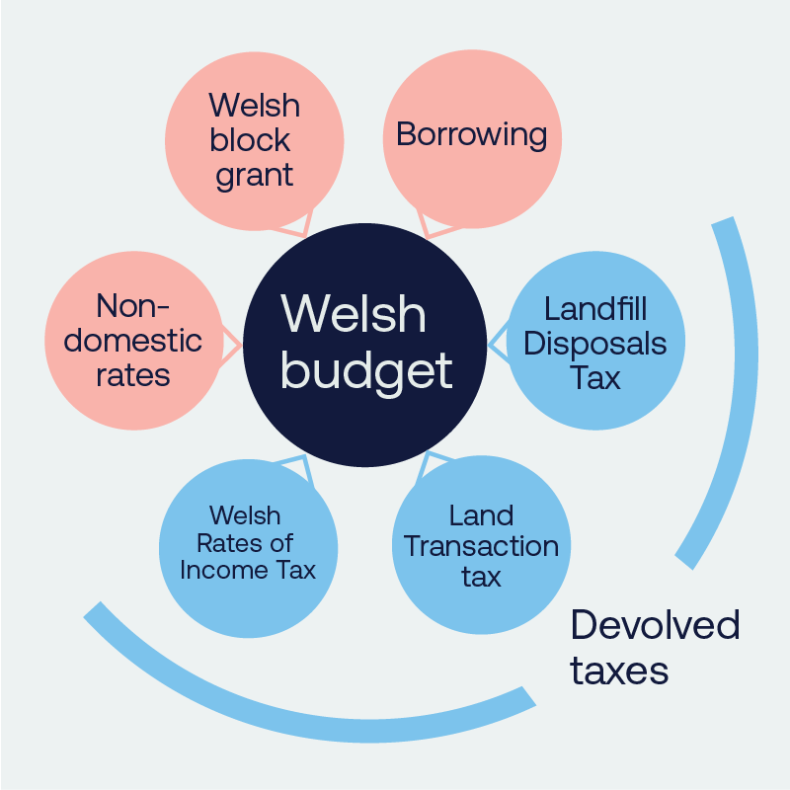

The Welsh Government Budget is primarily funded by the UK Government’s block grant, as well as through devolved taxes.

The devolved tax system allows the Welsh Government to raise more of its own revenue for public spending. For the first time in almost 800 years, the Wales Act 2014 legislated to devolve tax powers to Wales. The Act permitted the Welsh Government to legislate in areas to which Stamp Duty Land Tax (SDLT) and Landfill Tax (LT) formerly applied. These UK taxes were replaced by Land Transaction Tax (LTT) and Landfill Disposals Tax (LDT) respectively for Wales. The Act also legislated for the partial devolution of income tax to Wales, which was substituted by the Welsh Rates of Income tax (WRIT).

Sources of the Welsh Government's Budget

How is the budget decided?

The composition of the Welsh Government Budget is determined by The Office for Budget Responsibility (OBR) and the fiscal framework. The OBR develops Welsh tax forecasts, and the fiscal framework is an agreed set of funding arrangements with the UK Government to support Wales in its devolved fiscal powers.

The fiscal framework is made up of the block grant adjustment model and sets out an adjusted Barnett formula for Wales. The block grant adjustment model establishes how the Welsh block grant is modified to take into account the devolution of Welsh taxes and is not ringfenced to any specific Welsh Government department or policy area.

What is the Barnett formula?

The Barnett formula is a method used by HM Treasury to alter the funding allocated to Wales through the block grant to reflect changes in public service spending by the UK Government in England. It is the way the UK Government confirms that a share of additional funding allocated only to England is provided fairly to Wales, Scotland, and Northern Ireland.

The Barnett formula for Wales includes a needs-based factor, currently set at 105%. However, in the long term, the Welsh and UK governments agreed that the factor will be set at 115%.

The figure is calculated against all UK Government spend and is not ringfenced to any specific devolved department or policy area (such as health), so the Welsh Government can choose how to spend it.

How does the Budget process work?

The Welsh Government usually presents its draft Budget to the Senedd in the autumn of each year. The Budget is set in a multi-stage process, involving three components:

Draft Budget proposals: This sets out the Welsh Government's spending plans and provides opportunities for scrutiny and amendment by the Senedd, including Senedd committees.

The Final Budget and Annual Budget motion: This requests the Senedd's formal authorisation through a vote for the use of resources during the financial year.

The Supplementary Budget motion: This requests permission for in-year changes to the annual Budget motion.

What is the Wales Reserve?

The Wales Reserve, held by the UK Government, was formed for the Welsh Government to deposit any resource or capital funds that can be drawn down to fund future spending. Resource funds deposited into the Wales Reserve can be used for both resource and capital spend, but capital funds are limited to capital spend and projects.

The Welsh Government can save up to £350 million in the reserve. There are no limits for payments into the reserve and money can be carried across from one financial year to the next. However, the Welsh Government is limited to how much it can drawdown annually: currently this is £125 million for revenue and £50 million for capital.

What borrowing powers does the Welsh Government have?

The Welsh Government has restricted annual borrowing powers for capital investment and for managing the instability of tax receipts.

Resource borrowing: The Welsh Government can borrow up to £200 million annually within a total limit of £500 million, if tax revenues are lower than predicted. This must be repaid in four years.

Capital borrowing: The fiscal framework establishes capital borrowing powers, which allow the Welsh Government to borrow a total of £1 billion, with an annual borrowing limit of £150 million. This can be borrowed from the National Loans Fund (through the Secretary of State for Wales) or a commercial bank.

Government bonds: The Welsh Government also has powers to issue government bonds to borrow for capital projects which contribute toward the total and annual capital borrowing limits established in the fiscal framework.

How has funding for the NHS in Wales changed?

From 1 July 1999, health has been principally a devolved matter, since powers were transferred to the National Assembly for Wales (now the Senedd). Pre-devolution, around 34% of the Welsh Office Budget was spent on health services. 25 years later, this stands at 49%.

Welsh Government budget and Health and Social Services expenditure over the years can be seen below:

How is the NHS funded?

How is capital funding distributed across the NHS in Wales?

All NHS Wales organisations – LHBs, NHS trusts and special health authorities - receive an annual discretionary capital allocation from the Welsh Government. Most capital schemes are focused on enhancing patient safety and improving the delivery of clinical services, usually through the renovation and upkeep of existing buildings and digital infrastructure.

The Specialist Estate Service in NHS Wales Shared Services Partnership (NWSSP) also oversees the Estate Funding Advisory Board fund for the Welsh Government. In previous years funding has been targeted at reducing the maintenance backlog, including physical condition and compliance, improving fire safety in buildings and improving compliance in mental health accommodation.

The Welsh Government has acknowledged that “in reality, every hospital in Wales requires continual investment to maintain and upkeep premises”. The NWSSP Estates Facilities Performance Management System collects data from all NHS Wales organisations on an annual basis, which highlight the age profile of the NHS estate.

Can the NHS borrow or generate income?

Currently, the three NHS trusts (Public Health Wales, Velindre and the Welsh Ambulance Service) have borrowing powers under the NHS (Wales) Act 2006, but LHBs do not. NHS organisations in Wales are unable to acquire or sell surplus land to generate income without Welsh Government approval.

NHS organisations can generate some income through their charitable arm and in connection with its research functions. Any income generating activities must be complementary to the provision of NHS services and must be in accordance with the Welsh Ministers’ policy and powers to raise money as set out in section 169 of the NHS (Wales) Act 2006. Charitable donations must be used for a charitable purpose with public benefit, including further supporting patient and staff experience. Examples include initiatives that make the hospital environment more welcoming and comfortable, research projects, grants to pay for equipment or other non-recurrent assets for patient and staff to use.

Financial duties on the NHS

The financial duties on NHS bodies mean they each manage the budget they receive from the Welsh Government. LHBs, under the National Health Service Finance (Wales) Act 2014, have a statutory duty to breakeven over a three-year period. Special health authorities, under the National Health Service (Wales) Act 2006, have a statutory duty to breakeven annually.

Furthermore, NHS organisations must have a forward looking Integrated Medium-Term Plan (IMTP) in place, which is approved by the Welsh Government. An IMTP is a three-year plan which sets out how the health body will deliver the services required to meet its population’s health needs within the funding available.

Under the NHS Wales Act 2006 Act, LHBs are required to obtain the written consent of Welsh Ministers before: acquiring and disposing of property; entering into contracts up to the value of £1 million; and accepting gifts of property (including property to be held on trust, either for general, or any specific, purposes of the LHB or for any purposes relating to the health service). The requirement for consent does not apply to all contracts e.g. contracts of employment between LHBs and their staff or where one health service body contracts with another.

Summary

In conclusion, the NHS in Wales is publicly funded (i.e. by taxpayer’s money), as is the case across the four UK nations. The Welsh Government’s Budget comes primarily from the UK Government’s block grant for Wales, plus some from devolved taxes, such as the Land Transaction Tax. The Barnett formula is used to calculate Wales’ allocation from the UK Government, which is calculated against total UK Government spend and is not ringfenced to any devolved department or policy area (eg health). Therefore, the Welsh Government decides how much of its overall budget goes to the NHS in Wales.

The Welsh Government allocates revenue funding each year for Wales’ seven local health boards (LHBs) to plan, secure and deliver healthcare services in their area, taking account of the size of the local population in the LHB footprint and other factors that would impact demand for healthcare services. NHS trusts and special health authorities are also funded annually, but where and how they receive their revenue funding differs by organisation.

Other than through a charitable arm, in accordance with the Welsh Ministers’ policy and powers to raise money as set out in section 169 of the NHS (Wales) Act 2006, the NHS has limited means through which to borrow or generate income. Currently, the three NHS trusts (Public Health Wales, Velindre and the Welsh Ambulance Service) have borrowing powers under the NHS (Wales) Act 2006, but LHBs do not.